Most online accounting systems have tax codes that are tied to ledger codes. If this is the case, then when you select an imported ledger code, the tax code will automatically be selected.

Your online accounting system may support downloading of tax codes into Accelo. An administrator may review their integrations page and select to "Sync" ledger and tax codes. This is a one-way pull from your accounting system into Accelo.

Visit our Integrations Guide for more details on how to perform these integrations.

Once synced, the tax codes will be visible under the Tax Codes list in Accelo.

To view your Tax Codes:

-

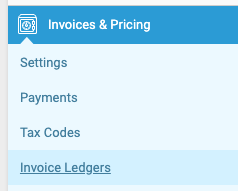

Click the Company Icon in the top left of Accelo and select Settings.

-

Select Invoicing & Pricing and then select Tax Codes.

Then when creating an invoice in Accelo, you will be able to select from the tax codes that match your online accounting system.

Create Tax Codes

An admin user can review the list of tax codes from the Admin navigation. They may also configure new tax codes using the Add Tax button. To remove a tax code, click the recycle bin button on the right.

A tax code only requires a Title and a Rate (%). Remember that if you have connected Accelo to an online accounting system then you may only be able to use imported tax codes when creating an invoice.