When you receive a payment through Accelo Payments, the funds are added to your Payrix account balance. This allows our payment processing partner, Payrix, to validate and process the payments, and to manage the movement of funds. To disburse the funds to your bank account, they will need to be withdrawn from Payrix.

Using this guide, you can understand:

Withdrawing Your Funds

Your funds will be automatically withdrawn from Payrix, and deposited into your bank account at 6pm EST on each business day. The withdrawal will include all payment batches which have been settled by 9:30pm EST on the previous day. No further action is necessary on your part.

It takes a minimum of one business day, from the date of the original payment, for funds to be available in your bank account. Please note that this process can be affected by holidays, high-risk transactions and funding delays for new users. You can easily determine where a particular payment is in the process by referring to its batch status.

Managing Your Bank Account

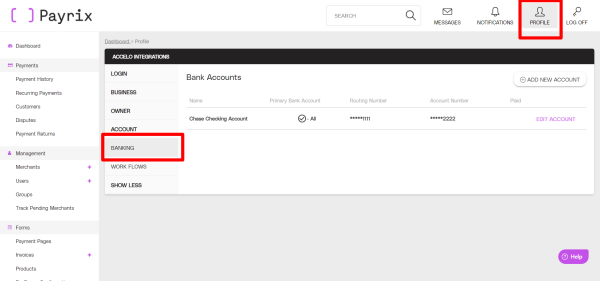

When your funds are withdrawn from Payrix, they are deposited into the bank account you've connected to Payrix. You can review and update that bank account from the Payrix portal.

To view your existing bank account, click Profile and select the Banking tab.

You can change your bank account at any time, by adding a new account. Simply click the Add New Account button and enter your new account information. Your funds will be deposited in the account listed as the "Primary".

Understanding Payment Batches

A batch is a group of payments that you’ve received during a single business day, including transactions from any weekends or holidays immediately prior. These payments are processed as a group, with a single status reflecting their position in the payment cycle.

All payments go through a series of steps before the funds finally arrive in your bank account. Those steps are:

-

Approved: The payment was authorized by the customer’s issuing bank, confirming the availability of the funds and validating the customer’s CVV (security code) & AVS (address) information. At this point, the funds have not yet been moved from the customer.

-

Captured: The payment has been sent to Payrix to begin the process of transferring the funds from your customer to your Payrix account.

-

Settled: The funds have been successfully transferred, and have been added to your account balance in Payrix.

-

Failed: The payment was not successfully made, and no funds have been transferred. This can occur prior to both the Approved and Captured steps.

-

Refunded: You have manually refunded the payment. Refunds can only take place once the payment has reached the Captured step, as funds have not been moved prior to that step and therefore can’t be refunded yet.

-

Voided: Payments which are still in the Approved stage can be voided. Voiding a payment permanently cancels the payment so that no funds are moved.

-

Canceled: Payments which are in the Approved stage can be canceled. Cancelling a payment removes the transaction from your daily batch, so that it is not sent to Payrix for processing and no funds are moved. Canceled payments can be added back to your batch within 24 hours of the original authorization. This can be useful when you need to delay a payment actually moving the funds.

How can I reconcile my withdrawal to my payments?

Reconciliation is a common accounting practice which confirms the accuracy of your accounting records, typically at the end of each month. This practice compares the payment records in your accounting system to the actual money in your bank account to ensure that they align, and reconciling any differences. For details on how to reconcile your fund withdrawals to your payment records, refer to the Payrix documentation at How to Reconcile a Disbursement in the Portal.