Your business needs to be able to accurately track its cost and revenue streams. Everything from Purchases to Invoices to Materials, and which clients those items are associated to, needs to be watched closely to ensure your business is operating profitably and effectively.

Using the Finance & Accounting Reports in the Accelo Reporting Module, you can gain deeper insights into your specific company's cost and revenue streams, ensuring nothing slips through the cracks.

In this guide, you can find reports for:

- Materials Overview

- Expenses Overview

- Purchases Overview

- Revenue by Invoice Date

- Revenue by Client

- Revenue by Invoice Owner

- Accounts Receivable Aging

- Outstanding Invoices

- Materials by Volume

- Material Profitability

- Purchases by Vendor

- Revenue by Material and Service Item

- Revenue by Kind of Work

- Time to Pay Invoices - by Client

- Time to Pay Invoices - by Invoice Raised Date

- Time to Pay Invoices - by Invoice Due Date

- Time to Pay Invoices - by Invoice Owner

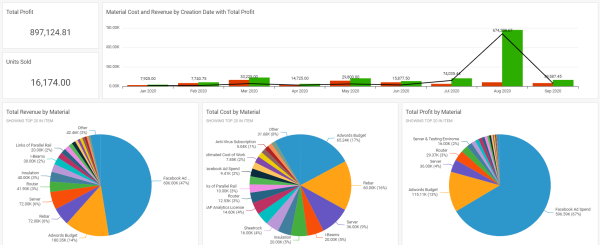

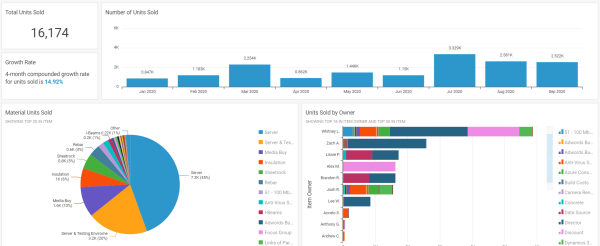

Materials Overview

Total revenue, cost and profit of all materials added to budgets, or invoiced for.

As a business who sells (and buys) materials, it is also important to track the cost and revenue of the materials bought and sold. The Materials Overview Report is for managers to review the cost, revenue and profit of those materials. Very similar to the Cost of Goods Sold (COGS) Report, except that report classically includes services as well as materials.

Some questions this report could answer include:

-

What's my profit for X material?

-

How many of X have I sold?

-

How are sales of X trending?

Report Filters

- Material Created Date

- Item

- Item Owner

- Kind of Work

Permission Requirements

- Access level: Administrator or Professional

- Licenses: (None)

- Financial Permissions: Financial Visibility

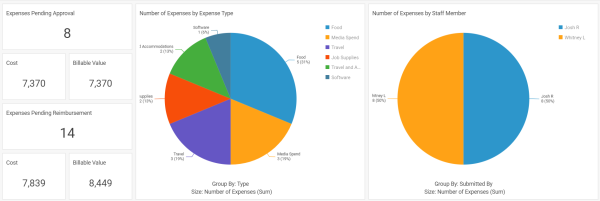

Expenses Overview

Overview of the cost and status of all expenses.

Helps accounting staff stay on top of the company's expenses

Expenses are an important factor in the overall cost of delivering services to your client, representing internal costs and potential billable revenue. The Expenses Overview report is a great way to stop on top of those expenses, by offering simplie summaries of all expenses, and highlighting those that need to be approved or reimbursed.

Some questions this report could answer include:

- Are there expenses that I need to approve or reimburse?

- What kinds of expenses are we incurring? Are we drowning in meals vs. flights?

- Who's incurring all of the expenses? Do we have someone incurring a lot of expenses that shouldn't, or someone recording a disproportionately large number of expenses?

- What's the historical trend in expense volume and costs? Is this month a spike in costs?

Report Filters

- Incurred Date

- Incurred By

- Type of Expense

-

Expense Status

- Reimbursable?

- Billable?

- Client

- Kind of Work

- Expenses for Specific Work

Permission Requirements

- Access level: Administrator or Professional

- Licenses: (None)

- Financial Permissions: Financial Visibility

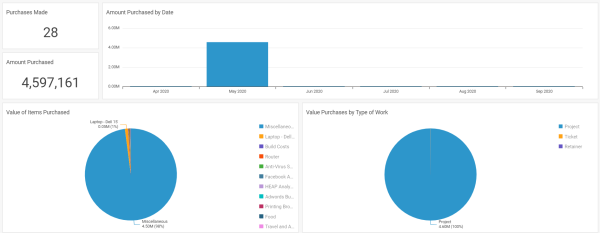

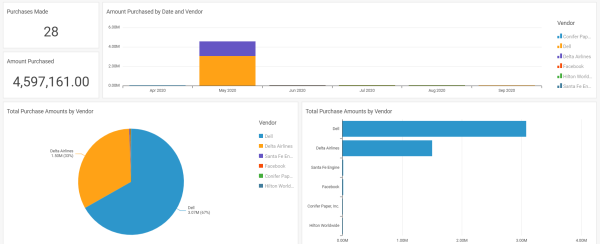

Purchases Overview

Review your purchases to see what you've purchased, what kind of work it was for, and any outstanding payments.

Tracking Purchases is a critical piece for any business. Understanding how much money has been spent on purchases, what vendors are being used, and what’s being purchased the most can be important for any business owner to monitor trends and make important financial decisions down the line. The Purchases Overview Report is great for accountants and purchasing managers to review the purchases that have been made.

Some questions this report could answer include:

-

How much have we spent?

-

Which vendors do we typically use?

-

Are there unpaid amounts I need to be aware of?

-

What are we buying the most of?

Report Filters

- Purchase Date

- Purchase Owner

- Item Purchased

-

Kind of Work

- Vendor

Permission Requirements

- Access level: Administrator or Professional

- Licenses: (None)

- Financial Permissions: Financial Visibility

Revenue by Invoice Date

Review your revenue based on the date which your invoices are due. Revenue is calculated based on invoices' pre-tax amount.

Revenue (invoices) are at the heart of any business. The purpose of the Revenue by Invoice Date Report is to show users how their revenue is trending over time.

Some questions this report could help answer include:

-

This month feels especially good/bad. How does it compare to other months, though?

-

We raise our invoices a month ahead of time. How does next month's revenue compare to this month?

-

What has X client's revenue been this year?

-

What has X account manager's revenue been this year?

Report Filters

-

Invoice Date

-

Invoice Owner

- Show Revenue By Raised or Due Date

- Kind of Work

-

Primary Account Manager

-

Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

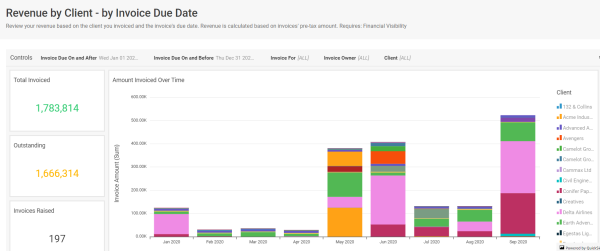

Revenue by Client

Review your revenue based on the client you invoiced. Revenue is calculated based on invoices' pre-tax amount.

Oftentimes, you may want a better understanding of how much revenue is coming in on a per-client basis. It’s also important to understand how these particular clients are generating this revenue (are they making more from Projects they’re working on, or Tickets, for example). The Revenue by Client report is also a great way for account managers to review their clients' value.

Some questions this report could help answer include:

-

How much has X brought in?

-

Are there any historical trends in clients' revenue?

-

Where are we making our money? Projects? Retainers?

-

For executives making decisions about the level of service to provide: Client X wants a billing concession, discount or complimentary service. Are they worth it?

Report Filters

-

Invoice Date

-

Invoice Owner

-

Show Revenue By Raised or Due Date

-

Kind of Work

-

Primary Account Manager

-

Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

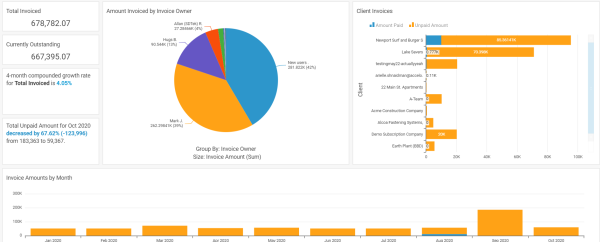

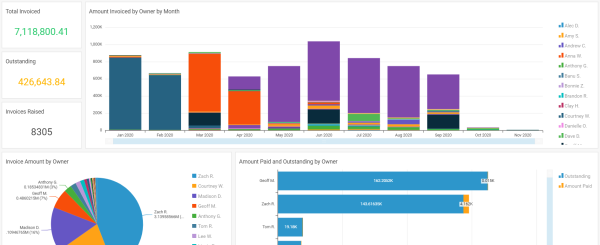

Revenue by Invoice Owner

Review your revenue based on the owner of the invoice. Revenue is calculated based on invoices' pre-tax amount.

The purpose of the Revenue by Invoice Owner Report is for managers and executives to review their revenue based on the owner of the individual invoices. This is meant for companies that equate the Invoice Owner with the person responsible for the revenue - typically either the salesperson or account manager.

Some questions this report could help answer include:

-

Who's responsible for our revenue?

-

Is anyone not performing well?

-

I need to pay commission based on amount invoiced. How much have we invoiced?

Report Filters

-

Invoice Due Date

-

Invoice Owner

- Kind of Work

-

Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

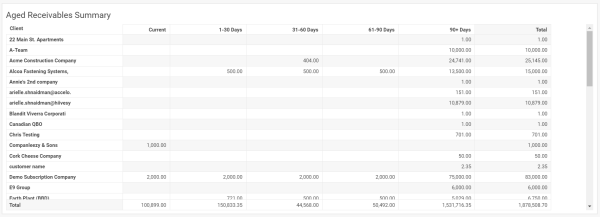

Accounts Receivable Aging

Review your clients' outstanding invoice balances, based on how overdue they are.

The Accounts Receivable Aging Report is a periodic report that categorizes a company's accounts receivable according to the length of time an invoice has been outstanding. It is used as a gauge to determine the financial health of a company's customers. If the Accounts Receivable Aging Report shows a company's receivables are being collected much slower than normal, this is a warning sign that business may be slowing down or that the company is taking greater credit risk in its sales practices.

Some questions this report could answer include:

-

How much is currently unpaid, but in terms?

-

How much is currently unpaid, and overdue?

-

How much does client X owe, and how overdue are the balances?

-

Do my clients pay retainer invoices on time, but pay larger, project invoices slowly?

Report Filters

- Invoice Owner

- Include or Exclude Tax

- Kind of Work

- Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

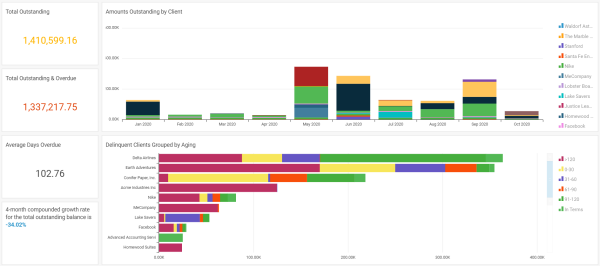

Outstanding Invoices

Review your outstanding balances, the clients they pertain to and the age of the invoices. Outstanding balances are calculated using the invoices' pre-tax amounts, and only includes balances larger than $1.00.

Outstanding invoices can be a pain. Long story short, you want to get paid by your clients, and having a greater understanding of which clients have yet to pay those invoices can prove to be extremely beneficial for keeping your business running properly. The Outstanding Invoices Report is great for accountants and account managers to review their outstanding invoices.

Some questions this report could help answer include:

- Who do I need to be reaching out to about outstanding balances?

- How much is currently outstanding?

- How much is currently overdue, and how overdue are the amounts?

- How much does client X owe?

Report Filters

-

Invoice Due Date

-

Invoice Owner

- Kind of Work

-

Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

Materials by Volume

Total material unit numbers added to budgets or invoiced for.

As a business who sells (and buys) materials it is also important to see the volume - not just the value - of the materials bought and sold. The Materials by Volume Report focuses on quantity as a way to offer insight on material sales to users with no Financial Visibility.

Some questions this report could answer include:

-

How are sales of X material trending?

-

Historical, how do sales look in January (or any given month)?

Report Controls

On the Materials by Volume Report, you can filter by:

-

Material Created Date

-

Material Item

-

Material Owner

-

Kind of Work

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: (None)

Material Profitability

Profit for all materials added to budgets or invoiced for.

Similar to our reports on Materials by Value and Volume, it is important to understand the Materials you’re buying and selling on the basis of their contribution to business profitability. To define a couple of key phrases:

-

Profit is Total Revenue - Total Cost.

-

Profit Margin is Profit / Total Revenue and captures the amount of the sale price that the business gets to keep.

-

If the Material has no revenue, it is illegal to divide by zero so we need to consider them as "No Income" items.

-

Similar to the way we "classify" payment terms, we'll also want to classify profit margin on a per Material basis as follows:

-

No Income: any material with a revenue price of 0

-

Unprofitable: where profit margin is <0

-

Low Margin: where profit margin is >0 and <=0.1 (10%)

-

Low-Medium Margin: where profit margin is >0.1 and <= 0.2 (20%)

-

Medium Margin: where profit margin is >0.2 and <=0.3 (30%)

-

Medium-High Margin: where profit margin is >0.3 and <= 0.4 (40%)

-

High Margin: where profit margin is >0.4 and <=0.6 (60%)

-

Very High Margin: where profit margin is > 0.6 (60%)

Report Filters

-

Material Created Date

-

Material Item

-

Material Owner

-

Kind of Work

Permission Requirements

- Access level: Administrator

- Licenses: Reports

- Financial Permissions: Financial Visibility

Purchases by Vendor

Details on all the purchases you've made from individual vendors.

Not only is it important to understand your purchases, but it’s also critical to gain insight into which vendors those purchases are being made. Seeing what you’re buying from certain vendors, understanding if you’re getting a better deal from one vendor to another, and just understanding vendor relationships can all be done via the Purchases by Vendor Report.

Some questions this report could answer include:

- Are we buying more of X from one vendor vs. another?

- Are we getting a better deal on an item from one vendor?

- How much have we spent?

- Which vendors do we typically use?

- Are there unpaid amounts we need to be aware of?

- What are we buying the most of?

Report Filters

-

Payment Due Date

- Item Purchased

- Purchase Owner

- Kind of Work

-

Vendor

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: (None)

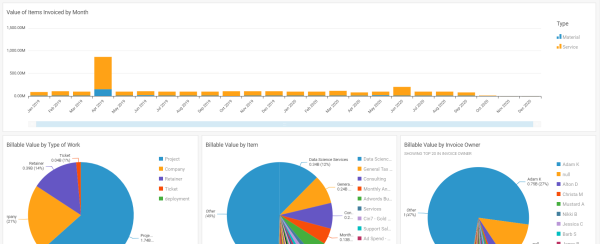

Revenue by Material and Service Item

Review your revenue based on the materials and services which you've sold. Revenue is calculated based on the pre-tax price of the material and service items used in your invoices.

The Revenue by Material and Service Item Report is a great way for executives to review their sales by the particular material or service item that was sold.

Some questions this report could help answer include:

-

Have we seen a spike or trough in any of our sales?

-

How much do we make from X material or service?

-

Should we promote or discontinue a particular product?

Report Filters

- Invoice Raised Date

- Invoice Owner

- Material or Service Items

- Item

- Client

- Kind of Work

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

Revenue by Kind of Work

Review your revenue based on the kind of work - projects, tickets and retainers. Revenue is calculated based on invoices' pre-tax amount.

Beyond the client or staff member who is responsible for an invoice, it's important for a business to know where their revenue originates, since that has implications on whether that revenue will continue into the future. One of the ways to determine that is based on the module that the revenue was generated from in Accelo. The Revenue by Work Type Report assumes that:

- Tickets represent a small, one-time revenue stream which is not reliable to continue.

- Projects represent a large, short-term revenue stream which is reliable to continue into the future.

- Retainers represent a small, long-term revenue stream which is reliable to continue into the future.

Some questions this report could help answer include:

- Where does the majority of my income originate?

- Client X has lots of work - where do we actually make money?

Report Filters

-

Invoice Due Date

-

Invoice Owner

-

Kind of Work

-

Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

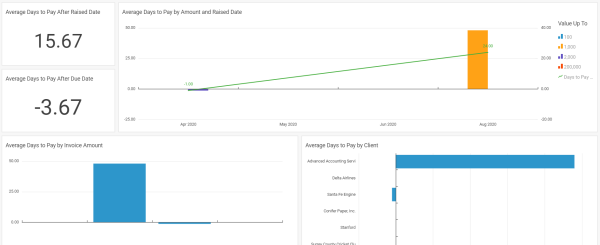

Time to Pay Invoices - by Client

Find out how long it takes for your clients to pay their invoices by focusing on individual clients. Time to pay is calculated based on when the invoice's due date, and when final payment was received, using the invoices' pre-tax amounts.

While other reports can show you information such as outstanding invoices, the Time to Pay Invoices - By Client can be used to see how long it takes the clients who are paying those invoices to do so. Long story short, this report is great for accountants and account managers to evaluate how punctual their clients are at paying their invoices. This report is expected to be used in tandem with the Outstanding Invoices Report.

Some questions this report could answer include:

-

When can I expect this invoice to be paid?

-

Do my invoice terms accurately reflect reality?

-

Are any of my clients taking advantage of me?

-

Should I implement late fees?

Report Filters

-

Invoice Due Date

-

Invoice Owner

-

Kind of Work

-

Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

Time to Pay Invoices - by Invoice Raised Date

Find out how long it takes for your clients to pay their invoices. Time to pay is calculated based on when the invoice was raised, and when final payment was received, using the invoices' pre-tax amounts.

The speed by which a company gets paid is extremely important to managing cash flow. This report is designed to show a manager or executive how timely their invoices have been paid based on when the invoice was raised or due, and can predict issues with payment terms stretching and potentially threatening the cash flow of the business.

Some questions this report could help answer include:

-

When can I expect this client to pay their balance?

-

What's my typical cash flow cycle?

-

What payment terms should I offer?

-

Client X seems like a good client, but do they actually pay their bills?

Report Filters

-

Invoice Raised Date

-

Invoice Owner

-

Kind of Work

- Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

Time to Pay Invoices - by Invoice Due Date

Find out how long it takes for your clients to pay their invoices. Time to pay is calculated based on when the invoice's due date, and when final payment was received, using the invoices' pre-tax amounts.

This report offers the same details as the Time to Pay Invoices - by Invoice Raised Date Report above, but for users who focus on the invoice's due date instead of raised date.

Report Filters

-

Invoice Due Date

-

Invoice Owner

-

Kind of Work

-

Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility

Time to Pay Invoices - by Invoice Owner

Find out how long it takes for your clients to pay their invoices by focusing on the staff who own the invoices. Time to pay is calculated based on when the invoice's due date, and when final payment was received, using the invoices' pre-tax amounts.

Similar to the reports above, the Time to Pay Invoices - by Invoice Owner can be utilized by managers to review their accounts team's performance as it relates to collections.

Some of the questions this report could answer include:

-

Are any of my staff performing especially well or poorly?

-

Are our invoice terms accurate?

Report Filters

-

Invoice Due Date

-

Invoice Owner

-

Kind of Work

- Client

Permission Requirements

- Access level: Administrator or Professional

- Licenses: Reports

- Financial Permissions: Financial Visibility