Invoicing with Accelo

[Adam] All right, hello everybody. Thanks again for joining us for another installation of our Best Practices webinars. Today, we're going to focusing on invoicing in Accelo. My name's Adam. So I'm gonna be the host of today's webinar. And I work in the Implementation team here at Accelo. And I'm joined by John, who's a Service Designer, who'll be taking us through invoicing. So we expect the session today to take about 40 minutes in total. And we're gonna be looking at a couple of different areas. So we're looking at the different integrations we do with accounting systems. We're gonna be going into detail about the templates you can use for different types of billing. And whether that's including invoicing for one-off pieces of work, or recurring. And we're going through, you know, the payment process. And finally, some uh, how to deal with service and material items. At the end, we're gonna have time for Q&A. So throughout the whole session, if you can send through your questions as they come up, that'd be great, 'cause we'll get to them at the end. I'm now gonna hand off to John, to take us through it.

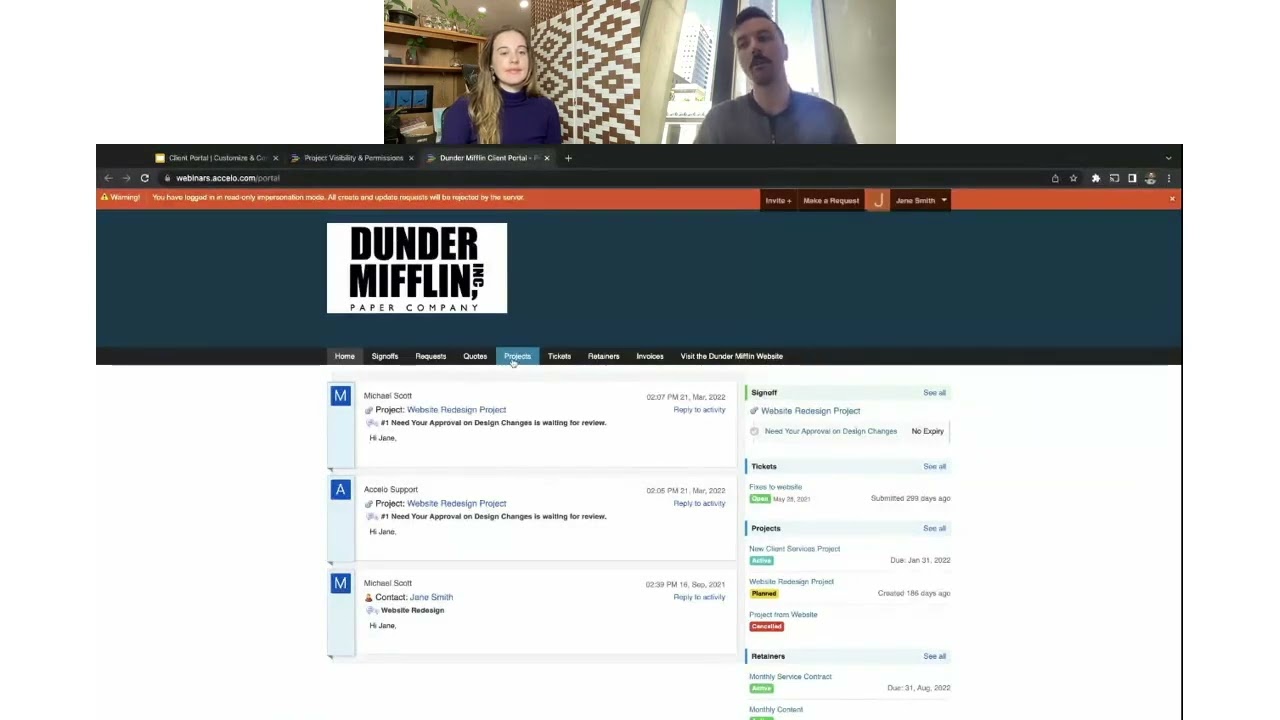

[John] All right, awesome, thanks Adam. So to kick it off, we want to give you a sense on where we see Accelo fitting into all the different software you might use to run your business. And especially for those who haven't yet hooked up their accounting integration with Xero, QuickBooks, online or desktop. So where we believe Accelo sits is just further down from where Marketing Automation and Sales Automation might sit in the Hubspots, the Marketos of the world. And then right above the Billing & Accounting systems, like Xero and QuickBooks. We think they do a really good job of keeping track of all the financials, like payroll and the general ledgers and account information. And what that does is it opens us up to be able to focus on budgets, automation, how to keep track of client work and communicate with them. The things that Accelo does really well. And this is where we differ a bit from other ServOpss or ERPs, if you're newer to Accelo or just watching us as someone who's considering Accelo, is we really wanna focus on workflows and invoicing out of the system. And then have accounting software focus on more of the deeper level financials. So today we'll be focusing on the invoice sync and how it connects to those deeper financial systems. The way that we integrate with Xero, QuickBooks, desktop and online, first and foremost is a two-way client sync. So what you can see here with contact name and company, address, email, and phone number, we have a two-way integration. So let's say that you added Paris and just sent her a recent invoice for a website from Accelo, we would have that automatically synced over to Xero. And vice versa, we have the ability to import all of your contacts from the other site. Going on that though, the way that the financials integrate is through an invoice sync. So, what you'll see here with the income general ledger, and the amount, tax code, tax amount, and description. These might be one item on an overall invoice, like we're only invoicing for a specific ticket or just for design. Or it might be many lines. Like it's a very large invoice for all of my work. And it might be design, QA, and development in it. Regardless, we sync with the income general ledgers that go over to the Xero side. And we have the ability to import those general ledgers when you're just starting off to make it easy to start the sync. The other way around, after the invoice, is recording the payments. And we'll touch a bit more on this later. But you can record a payment on Xero, Quickooks, Accelo, or through one of our third-party integrations, with someone like Stripe or Authorize.net. And those payments will integrate both ways as well because they're going through that invoice sync. So what we want to start off with is the building blocks of how invoices are created, within Accelo. And those will be through what we call templates. And there's three components that we're gonna dive into on the templates. The type of billing, what to include on the invoice, and then visually how do we display that. So we'll look at first fixed price project. And 30% upfront invoice. A down deposit invoice. And then a bit later in the call, we'll focus on a time and materials template. All the templates for invoices, and mostly all the settings that we'll go through today is through Configuration. And the way that I find that is through the cog on the bottom left-hand of the screen. And right now if you go down the list on the left-hand side, most of our configuration will be in the Invoice & Rates section. And right now, I'm in Invoice Templates. So like I said, on that down deposit, fixed price template, what I've done is I've set up some defaults so that every time we invoice for any of these different objects, we can then have pre-default settings for what's included. In this case, on project work, I wanna invoice for 30% upfront. Whereas maybe ad-hoc work like a ticket, I might invoice for 50% upfront. There are three different ways that you can include billing, or work information on an invoice. There's the fixed bid approach, or value-based pricing approach of a percent budget, similar to a down deposit like 30%. Or maybe you're just trying to wrap up at the end of the project and you wanna invoice for all the remaining budget. Those are two options for the fixed side. And then on the time, materials, and expense side, as we'll cover on the ticketing, what we can do is Work Done. And what Work Done does is it takes all of the work that we've done, usually the time, and then multiplies it by billable rate to get an eventual time, materials invoice of them. You will find the settings for the three different objects, or areas, that we can invoice from. The Project, Tickets, and Retainers here. And most of them have similar settings. So for example, Mark as Invoiced, if I want to mark the time that I've logged as invoiced. I can say all are approved. Same on the Ticket side. Where projects differs a little bit is how much I want to include on the invoice. And most of the times we're finding on fixed price, or especially that down deposit, that we'll show the milestones that are involved, and how much. But let's say that it was a very small, like a, a server upgrade, or maybe a little WordPress site, what I would do is probably just show Project as a line time. And then on some of those more complicated, bigger projects, we're finding customers showing everything. All the Milestones & Tasks. It just gives you flexibility on making sure that I'm not having to make this decision every single time. It's just easy, I drop in this template, and invoice for the work. Especially for that smaller work. Going down to the next section on Materials & Expenses. At least on fixed I do want to include everything, to pass that through to the customer. And then the last part of the settings here, or at least the structure, is the email template that gets sent out. And what I can do is I can pull in Merge Deals on the right-hand side to include more information than just a quick hello, as you can see here. So those are the components that drive the invoice. The next section is more around the visuals and the layout. So what I have on the left-hand side is ways to change the style, like the font and the themes, to more align with more maybe your brand. And then, what to include. And the most common area that we see what to include is around the Services. So in this case, on a fixed-bid project, I'm not invoicing for time, so I'm not showing any hourly rate, or the number of hours that I've logged. And same goes on the Work Details side. I'm not showing any of the work detail here, only really high level of what I've done. And that's because I'm not, again, invoicing explicitly for all the work that I'm doing. It's more the value of the website that I'm building. Or the consultation that I'm engaging in. The last part of the structure to bring into the visuals is Merge Fields. So, what you're finding here with things like account phone, email, even invoice information, we can drag in more merge fields to give more contacts to the customer. Or we can start taking some away to make it really simple. The last part is, in here. We can move things around. So account address, account phone, maybe the size of the logo, we can change the size. If we wanted to make this smaller. Maybe make it a heading number five. And invoice notes, perhaps I want to make it bullet pointed. So there's a lot of options. And if you don't like what you see, or you wanna do a bit more, we have the opportunity for you to go into HTML. And you'll have the option to edit inline here, if you know HTML or lightweight CSS. So those are the building blocks on top. And then the last option is down below. We can enter in more subtotals or again, change the font and information there. So those are the three different ways that we can change what we see on a template. Now what I wanna hop into are the two examples that we're discussing. And especially the first one that we're mentioning around the fixed price project. This brings us into one-off invoicing for specific work, like a specific website that we want to invoice for 30% upfront. And while we've already looked into the template, and more or less filled it out, what I want to review is a bit of the progression on how we build invoicing into a process so that we don't forget about it, the ball doesn't get dropped, things like that, that tend to hurt our cashflow and hurt our process within our organization. So what we can do is we can take something like a website. And I'm just gonna move it back into plan phase, 'cause it's already active. And as we move it from one phase to another, we can automate some actions that help us in the invoice process. For example, when we move it from Planned to Move to Active + Invoice, it can drop us into our workflow. One common one that we're finding, and this is more if there's a controller, CFO, or maybe an outside bookkeeper who's involved, is we can build in an automated internal alert, or a note to someone who's involved in the invoicing process. And this is more often than not, if that person is not involved in the project process. So as we're moving to an active project, we kick it off, and we have another team do the invoice. The second option that we see. And this might be the next step in another process. Would be dropping directly into an invoice. And this is what we see when there's a lead consultant who is really the project owner, and has the relationship with the client, sending the invoice. If there's a project manager, an account manager, managing it and also keeping an eye on the invoice and hasn't been paid, building this invoice into the process has been really helpful saving time and just making sure they don't forget when they take off the project. So what I wanna do is just briefly show you how to build that into the process. And that would be through Projects. And we call them Status Progressions, so you'll find it under here in Progressions & Fields. So every time I create a new fixed price website project, and I move it from Planned to Active, I wanna do two things. And like I mentioned before, it's likely that we'll just do one of the two things, depending on how we want the workflow to go. One being this internal alert that's getting sent off. And then the other is what we call an action. And it's a special process. So you'll find it under here. And you can do things like a sign out, create sign offs, and another important thing, as we're finding here, is building an invoicing into the process. So that's how I built it out going from active, or planned to an active stage. Now what I'll do, since it's a down deposit, and it's a project, is it's referencing all of the information that I set up for project template. Percent budget at 30%. I would love to show my different milestones. And it's now pulling in the design and development milestones. What you'll see is the total milestone value is 2,000. And it's saying I would like to invoice for 30% of that budget. That's why we have $600 here as the amount that's going to sync over to Xero, QuickBooks. And then something that we'll touch on later is you can pre-template service codes, and the right general ledgers that will connect up on your accounting software side. So, like I said, it's a bit more of an advanced feature that we'll show. I can edit it on the fly, here as well. But that's basically how the integration works. We can see the server and testing environment, that we're setting up for them too. No expenses to be included. And on the visual side, we'll have all the account information, invoice numbers. The two different line items. And no information about any time that has been logged because we're not invoicing for time, we're invoicing for a fixed amount, or a fixed value. So now, how will I start the integration, and how will I send the invoice out to the customer is through here. Any time you save an invoice in Accelo and have the integration set up, it's automatically gonna sync over to your accounting software. And then the Send function would send an email, the PDF to the customer, using that template email that we had set up on the template side. So now what we'll see on the project, is we have an invoice, we've sent it out, and we currently have a little more than 15 thousand outstanding because we haven't recorded the payment, either in Accelo or on the Xero side. Another scenario that we find often is how do we bulk invoice for all work? I don't wanna go into every single project, or every single ticket. What happens if it's end of the month, and I would like to invoice for all the ad-hoc tickets or rate fixed tickets that have been resolved in this past month, or really ever? And what we can do with bulk invoicing, it's just not for ticket work, but that's the example that we'll talk about today, is I can run a report across all work, all statuses, all time that's logged. And it's a really nice way to save a lot of time instead of having to dig into each, to send out emails. And it also gives us the ability to group up pieces of work to send to the client, instead of inundating them with a bunch of invoices. So the first thing that I wanna show is the work that we are eventually invoicing for. And what we see here is we have a few tickets. One that's opened, one that's waiting, and a few other that are resolved. And what I'll do is, I don't run the report from here, but I just wanted to show that these are the tickets that we're eventually invoicing for. And on top of that, within them, we can see all the billable work that we have yet to invoice. So the way that I do bulk invoicing, or, in your account it might be called company billing, is through here. So the template that I wanna select is Time, Materials, and Expenses. I'll pull a report on all active companies, I don't wanna include projects or retainers. And then on the ticket side, I'm selecting all of the tickets that have been resolved. If you're invoicing across a few different types, you might be invoicing for all closed and resolved tickets, rather than just resolved. In this case, we're invoicing for only one. And then, you have some more options to drill down even more. So what's pulled up are the three tickets that are rate fixed, meaning that they're sitting alone. They're outside of a contract. And we wanna invoice for them. In this case, at the end of the month. And all I have to do is select all of them. And I can jump into an Invoice Wizard. This will bring me through each of the companies. And it's really easy way to group those tickets. And quickly send them off. So what I'll see now is this invoice is gonna look a little bit different from the fixed bid, or the down deposit invoices that I sent out for a project because I'm using a different template. Some of the fonts here are a different size. You'll find that I'm using time and the cost on the line items now. As well as including the work detail. So this is something that I've set up on the template, or I can edit it on the fly. You'll find here the ability to take away or include things like the subject and the body. What we've found as the best practice is if we're invoicing time and materials, we probably want to include at least the subject on what's involved. And probably who's working on it, unless if I have a general support room that they'll work with, rather than an individual engineer or consultant on my team. And then sometimes, our customers like to include the body to let them know exactly what we did. And how we solved it. This is one of those things that helps have transparency and illuminate the value and the time that you're putting into the customer. Where they look at an invoice and it's just not a line item for the work. It's a lot of work that we did with them, or for them throughout the month. So when I create it, it'll sync over to our accounting software, like Xero or QuickBooks. And when I email it, it's going to automatically send off to our billing contact there. In this case, it's Edward. And now we go right to the second company that needs to be invoiced for Fairmont San Francisco, with the website 404 and update logo ad-hoc. Similar thing on the edit preview. Now it's just two tickets. With the two line items. As well as the different work logs for the two different tickets. And sometimes what we're seeing, instead of grouping them by the ticket type, we want to group them by the staff who was working on it, if it's more of an account manager role model, rather than a general ticket, or like a support cube. So now I'm done with all the bulk invoicing. I've gone through all the tickets that need to be invoiced for the end of the month. And I've pretty quickly gone through everything and grouped it up. The last way that we can invoice within Accelo, or at least cover today, is on the recurring automated invoice through a ongoing revenue model. We call those retainers. And some of our customers call them ongoing monthly bookkeeping, support contracts. This may be ongoing project work, with an SEO or PPC. Maybe I'm keeping track of a social media campaign over a few months, and I just wanna invoice upfront every single month for that. All those can be achieved through what we call retainers, and setting up these recurring automated invoice. So what I wanna do is just set up a quick example of a retainer and show you what that looks like. So let's set this up for Delta and might be an SEO retainer. What I can do is I can select types. And what's really powerful about retainer types is they're similar to project templates, in that they pull in all the tasks that need to be done every month, as well as the materials that are planned to invoice for every month. They're also in some ways a retainer template because they can define the invoice structure that comes out of it. For example, in this case, every month, so it's a fixed duration, otherwise if it was unlimited, I would probably be invoicing when it tops up through the bulk invoicing that I just showed. Prepaid for $2000 every month for ten hours. Otherwise, again, it might be through bulk invoicing that I would do a time and materials post-paid. And then more often than not, I'm keeping track of the fixed hours. Whether it's explicitly said in additional agency to the client, or it's just implicit. We're trying to track how many hours the monthly bookkeeping of running payroll takes. And in this case, I want to at the end of every month, renew it. And then send an invoice for the upcoming period, either on the 1st or the very end of the month. So this would create the invoice. And any time I create an invoice in Accelo, it's automatically gonna sync over to Xero, so we don't have to run a large report or manually send invoices now for all of our ongoing work. We can just have it automatically send, and sync over to Xero. And then, taking it one step further, we can automate by sending that PDF off to the client, and letting them know that they're on contract with us for another month or year. Then the next part of the invoicing side is if we go over our ten hours, we can have an excess rate and that's invoiced for time and materials at the end of every period. In this case, a month. So if they use 15 hours, we'll just invoice them for $150 an hour. And top them off. Otherwise, if they use eight hours, what we can do is we can take that credit of two hours, and instead of them losing it, we can roll it over to the next period. So now they'll have 12 hours, in then next month, before we go to an excess rate. So that's been really helpful for people who are overusing. And we say, fine, it's okay if you overuse. We'll just send you a quick invoice, using bulk invoicing. No big deal. And then the other way around, we can track and not really overcharge, or at least have value continued to the next month. And sometimes we're seeing people at the end of the year plan larger projects within that retainer, so that they're still delivering value for the price that they're paying. And you can keep them on retainer and pre-paid price. 'Cause it's a lot easier to retain than try to find new project clients over and over again. The last part about the retainer is we can differentiate your ongoing contact for, maybe it's marketing, or maybe it's the support manager over at the client. And then differentiate that from the billing contact that we always send. Maybe it's their account statement. And what this looks like live, month over month, if we were to create that retainer for upfront invoicing. Is that we would see the usage in all the previous months, and then, I didn't automate this yet, but there would be an invoice that had already been created, from the previous month's setting here. So those are the three different modes of invoicing from a very high level. What I wanna switch into is, great, we've sent the invoices out, now how do we actually get paid for the work that we're doing? Now I'll really briefly talk about the mention, or the methods in which we get paid. And then we'll talk a bit about keeping our eye on when money is coming back into our firm. So most of the methods, again, would be under Invoices & Rates. And Receipt Methods would give you all the different ways in which they can pay, or have options on the, the invoice that we send out. So you can add as many options, and put some detail into how they can pay. And then secondly under Settings is where we can put a bit more description. So here we have Custom Payment Methods. We can write out things like wire transfer, or the business information, and how we, we transact with them. And then the second part of it is our integrations. So we have credit card or tokenization integration with Stripe, which integrates really well with Xero. Authorize.net. And then the last one isn't really a credit card integration. And that's through PayPal. So all three of these would create a little credit card, or in this case, a PayPal link on the invoice and the email. And they can easily click on it and pay. Or through the client portal, they'll be able to click on it and pay from the client portal. So what I wanna do is I'm going to pretend that the customer has paid us, either through the client portal, or they sent in a check and we just recorded it. So what I did was just pull a list of all the invoices in the system. We can see here that there's still $396 outstanding. And that there's no payment entered. And regardless of where I record this, either on the Accelo side or the Xero side, all the payments can be recorded. Maybe I'll put the check number. And they paid in full. So now we can see here that the Xero and that the full credit came in. Meaning that we have zero dollars outstanding. And if we are to pull a list of all invoices now, we would see that that, or I believe two tickets, were paid for zero days after, and we still have outstanding payments. But because of the template we set up contract terms of 14 day, or net 14. So they're not owing us anything 'cause it's still outstanding. I'm just gonna quickly receive a payment for this website down at deposit as well. Let's pretend it came from Xero. Other ways that you might keep your eye on payments is from the company. We'll be able to see high level KPIs, like how our revenue is trending. And from invoices, all the invoices for our work, whether it's retainer, project, or ticket would roll up to here and I could quickly see what's outstanding and not. This tends to be more of that CEO, CFO view. Whereas account managers and project managers might be spending more time in the project, and keeping their eye on the invoice from here. So we can see the invoice sitting, as well as the standing amount. And the last piece of it is taking a look through the Insights area. And what this will do is it will give us a sense on how much that has been invoiced 30%, and how much earned value or work has been logged, and what the delta or difference of it is. And this has been really helpful for seeing on down deposits how much that we've eaten up, or burned into that initial money that we got. You can almost think of these as taking a retainer upfront for the work. And then the other way around, we're always keeping our eye on time and materials. How much work that we have logged versus how much we've invoiced, and making sure that the delta isn't too big. Again, so that I'm getting paid for the work that I'm logging. Hopefully it's not more than one or two weeks after the work that I'm invoicing for it, and getting paid for it. Then the last piece of it is a higher level report. And honestly, most people who are really into the finance side of it would have access to the accounting system, and be able to pull the exact same report. But what this allows you to do is open it up if you want an account manager, or A.M., to have their eyes on it. You can see what's outstanding. What's in terms, and then the 30, 60, 90 accounts receivable in aging. And again, that was through Reports and Invoice Statements. The last piece on the setup is around service and material items. So service items tend to be on the work side, like task. And what general ledger a lot of the bench are actually pointed to. Then materials allow you to give somewhat of an inventory list of what you can sell. And again, looping it back to general ledger or income codes on the Xero or QuickBooks side. So what we'll find here is service lists. Yeah, this one. Is a few different codes and selections that we have. And what I wanna add is a development service list, so I can tie it back to a specific general ledger code. Putting a note that it's used for really any tasks that involve this. And then I wanna relate it back to the development comp code. And I'm not going to tax for this work. And now what I can do is, within Project Templates, in my project plan, like website, I can connect services to tasks. And this is gonna make it really easy for us to invoice for the work, knowing that it's gonna go back to the right general ledger. Select Development. And same goes for the CSS and the testing side. I would go into the Task Template Budget, and then select the right service item that eventually points back to the right general ledger code. Similar workflow on the materials side. I can create a new material, like a laptop or a MacBook. Can include its code. And then the only thing that's different between this and the service, is that materials are actual tangible goods. They're not a task that I would later put a billable rate on. So that's what we see here with Revenue Price and Cost Price. Cost, how much do I get it from the vendor? Or how much does it cost me to make it. And then revenue, how much we're eventually invoicing the client. And similar to the service list side, being able to automatically relate it back to the right general ledger for tracking financials. That's everything that's in Accelo now, on the invoicing side. Well, not everything but at least for a short overview of what our invoicing can do. What I wanna talk a bit about is our vision for where the invoicing, billing, and accounting integration will go. And one of those is around purchase orders. So if you didn't have a chance to watch our purchase sneak peak, our recording is on our blog, at accelo.com/resources/blog. That's the best place to watch it, and to read a bit about what we're planning to design out. From a nutshell, from a very high level, it's a way to incorporate expenses that come from our accounting system, and relate it back to either vendor purchases or contractors. Maybe I'm outsourcing to a film crew, and need to keep track of that on the project side. Or really on any work side, honestly. This will be a way to allocate those. If you look at our invoicing integration, and think about it, they're all income codes. We'll then open up the ability for all expense codes and integration on that side. So it's really fully a two-way integration now with the invoicing. Or at least, the accounting side. The other aspect of it is we have really good automatic recurring invoicing, but the last step for a lot of our customers is being able to automatically bill. And those will be things for, anywhere from hosting and the small thing that we get often, to even larger, on SEO or ongoing monthly bookkeeping. We've had a lot of customers that now that they've seen the automated invoicing, taking it to the next step and getting paid automatically at the beginning or at the very end of every month has been something really desirable. And something that we've started investigating. And that's not a specific timeline, but we get the question a lot. And that's something that we're currently working at. We'd love to have it come out this year, but I can't make any promises. And then the last part of it is around the invoicing API. We've, in-house, worked with Intuit, which is the owner and creator of QuickBooks, as well as the Xero team to build really deep integrations. But for some of our customers who are using other accounting packages, like Intact or Sage 50. Or who are in regions that we don't support, like Africa or the Middle East, there might be a specific accounting package that only works in that country, and has all the right information in tax and laws and regulations that wouldn't make sense for us to build out. But we still really want you to use the invoicing and accounting integration to get the value outta that. So what we're doing is we're currently working on our invoicing API to build it out. It already exists. It would just be for helping you work with developers. Or if you're a developer yourself, to be able to build those custom integrations with the accounting packages that you love. And have had come to work with.