Xero & QuickBooks Integration

Focus areas in this session include: Xero vs. QuickBooks Online - which one is right for my business?, How Xero & QuickBooks Online 'talk' with Accelo, Importing data from your Xero & QuickBooks Online account (clients and General Ledger Codes), Integration settings, Streamlining income and cost code tracking with Services & Purchase Templates, Billing reports and cash flow to make sure that I'm paid on time for the awesome work that I do!

[Tom] Okay, let's get going, shall we? Thanks for joining us, everybody, for another episode of Accelo Best Practices. Today we're going to be focusing on Accelo's integration with the two Cloud-based accounting platforms that Accelo integrates with, Xero and QuickBooks. Whilst the integrations with each platform have a couple of minor differences, the way in which they work with Accelo is fundamentally the same. We're going to touch on a couple of the differences, but we will be using examples from both platforms. I'm your host, Tom. I'm an account manager here at Accelo, and I'm joined by John who's a solutions engineer and will be the primary presenter today.

[John] Thanks, Tom. First we'll kick off on a high level, how the integrations work. As Tom was mentioning, the integrations work very similarly between Xero and QuickBooks Online, so we'll cover both of those high level integrations, and then we'll dig into the integration setup. This is where the integrations start differing, very little between the two, but it's good to mention some differences that exist in both. Then we'll spend some time, after you do the initial integration setup and import, what that looks like in Accelo, where you can see if the integration worked or pieces that may have not worked coming over. We're going to share some best practices on financial control, specifically how we can start templating some of our work on the top of the funnel with different financial control metrics, like service items and general ledger codes, so those stream into our accounting system seamlessly. Lastly, we'll show this live, what it looks like if you were integrating with Xero, all the way from quote to payment, as well as QuickBooks Online, what that process looks like.

[Tom] Sounds good, John. Guys, as we go along, feel free to use the Q and A function. We do have some dedicated time in the middle of the webinar, also at the end. If anything is super relevant, I'll jump in and ask John there as well, but yeah. Feel free to ask questions. If we can't answer anything on the spot, we'll of course be happy to follow up with you afterwards. All right, let's get going.

[John] Awesome. Thanks, Tom. To kick it off and to show where Accelo fits into your whole entire service operation stack, where we see Accelo is sitting on the operations side. That's bringing in new clients, quoting, doing the work for them like a project or moving into the ongoing services side, like in retainers and tickets. For the customers who are watching this webinar, they can say, "Yes, Accelo is the tool that I use for operations," but there are often other sides of your service operations, rather than just purely the operations component. Part of that is the services and marketing. The last best practices webinar, we talked a bit about how HubSpot marketing email automation platform can integrate with the service operations automation side, meaning Accelo.

Then, there's a lot of Professional Services Automation (PSA) out there that say they do finance and did start in the finance side and moved into Accelo's side and operations, but we think that finance and accounting platforms out there, including QuickBooks Online and Xero, do a really excellent job, so we let their teams focus solely on making awesome applications for what they do, and then we build a very tight integration with those applications.

What you can see here are some of the high level things that we integrate with, so that you can seamlessly manage your operations while still having financial control in invoicing, syncing down to the finance side. Those things are clients, contacts, and any suppliers or vendors who you work with. We have a two-way integration with your invoices and payments to your clients, and then we'll also sync the purchases and payments that you make for those, if you are working with any vendors or have any expenses come up on the work that you do.

Now, from a high level, this all looks great, but how does it actually work? First off, on the invoice side, like I said, it's a two-way invoicing. Any invoices that we create in Accelo or any invoices that we create in Xero or QuickBooks Online will sync back and forth, and we'll dig into some of the settings where we can choose whether they sync back and forth as well. On the invoice, we'll sync your services, whether it's design or development. Any materials that may be used during the project, this could be a server that you purchase or a print brochure that you get printed offsite and it's not within your company, and expenses as well, whether it's gas and travel or any things that you need to purchase like paper and pens for an onsite service design session. We'll also manage the payment side on the invoices, and there's a two-way sync that comes out of that as well.

Digging into what the two-way invoice sync looks like on the services side, here are some of the items that we sync over, including the income general ledger, the amounts that we sent to the client, tax codes, and then also a description that comes over on the invoice.

The two other pieces more or less match what the service piece is, so print materials or tax codes and descriptions. The vendor cost side, just hold onto that thought. We'll talk a bit about that on the purchase. Then, if you pass through any expenses that you may incur on the project, or ticket or retainer, you can then invoice for those as well and send them to the client.

The two-way client sync is a little bit different than the invoice. If you want to bring in client information from Xero or QuickBooks Online, we have initial import, which allows you to bring in those clients to Accelo as you start off or periodically. Then if you make any changes on the Accelo side, and we do suggest to make your changes on Accelo, those changes will sync over to Xero and QuickBooks Online through an invoice. That's something important to differentiate. It's not on the live change. If I accidentally misspelled Stacey, her name doesn't have an E in it, and I update that, it will get updated on the next time that I send Stacey an invoice.

Moving to the purchases side, we have a two-way purchase bill and expense sync. These are different items, it's just different ways to say the same thing, so it depends on what system you use. In Accelo we call them purchases, in Xero they're called bills, and in QuickBooks Online they're called expenses. Regardless of what we call them, if it's a print example here, we're getting brochures printed. Here are the items that can sync over, very similar to the invoice. Material purchase and vendor cost amount, tax information and description. Same with expenses like travel.

If I work with a vendor like the Jacksonville Print Company to get my brochures all printed for my clients, we're able to have a two-way vendor, or you can call them suppliers, I believe in Xero they're called that. Then we have a two-way sync similar to how the client sync works.

Those are the main components of the integration. Now what I wanted to do is jump into how we start setting up these integrations.

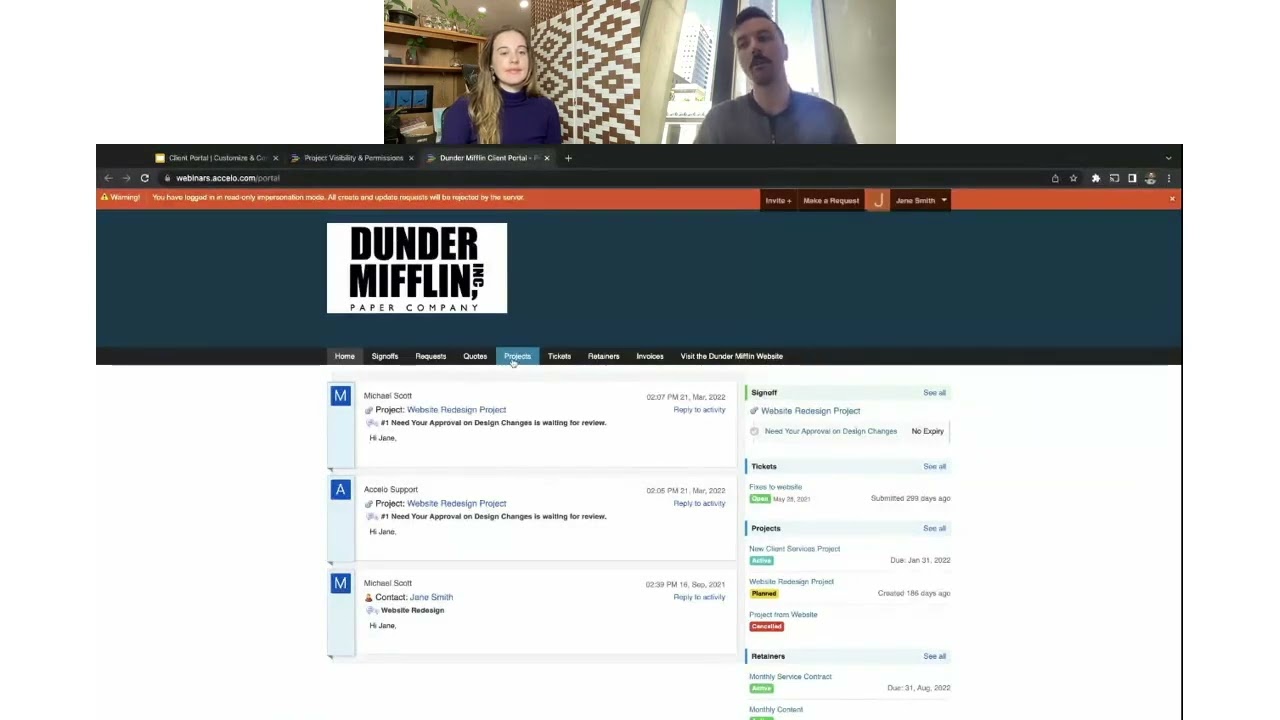

What we'll take a look first is at the Xero-Accelo integrations, some of the sync options that we have for initially setting things up, as well as the import options for getting companies contacts and some of my invoices that I may have already in Xero into Accelo, so that there can be parity between the systems.

Right here I'm in the integrations page. The way you get to this is you hover over the top-right-hand user management area, and I go to integrations. If you were integrating with something like G Suite, Gmail and calendar, you would see it in green up here as well. Right now I'm not integrating with that, and that's why it's yellow. The only integration looks like right now set up is Xero.

Here are some of the sync options that we have. By default, it would sync from Accelo if you set this up from Accelo to Xero. This line item allows the two-way sync of the invoices. This piece is unique to Xero. We have the opportunity to sync it over as a draft invoice, or we can sync it over as an authorized or a waiting payment invoice. The best practice that we've seen here is, if you're hesitant or if you've just got it into the integration and want to test and see what it looks like, we suggest using the draft invoice. When it moves over to Xero, that allows you to make edits or changes to it before locking it down and sending it off to the customer. Then as you get more comfortable with integration, or perhaps you've gone through an implementation with the Accelo team and are comfortable, then moving it to authorize will allow you to skip some of those points. You can send the invoice directly from Accelo and it will move into Xero as a waiting payment.

Moving to the payment side, while we suggest you record your payments in Xero, QuickBooks Online, if it's a cash or check or using a third party credit card vendor like Stripe or Authorize.net, you can still push payments created in Accelo over to Xero, so that's what this line does. Here this is making sure that your companies, contacts over in Accelo are integrated back and forth. On initial integration, what's unique with Xero is that we can set up custom fields on the Accelo side, or statues that match what they look like on the Xero side. Companies in Xero are coming in as active status over in Accelo, and then suppliers in Xero will come in as, in this case, vendor/partner status in Accelo.

Here this is where payments will get pushed into Xero, what account ledger it is. In this case, I haven't selected anything. Then the last piece of this is the often one-time import, or if you've updated some of your products and services and want to manually sync them or bring them into Accelo, here's where you can set this up. Any of your general ledger and tax codes product and services, these would be more detailed line items like design and development. Your initial list of all of your companies and suppliers, and then pulling in all the invoices that you may have in Xero into Accelo, so that you can see invoices in both systems, so that now the account managers and project managers can see invoices, whereas it was originally just our bookkeepers and controllers who could see that.

Those are some of the sync options and import options for Xero with Accelo. Moving over to the QuickBooks Online side, similar place that I access through the integration area. Now you can see in this example that I do have a Google integration set up.

Moving to QuickBooks Online, this will enable or disable the integration, similar to Xero, pulling new invoices in. This is unique to QuickBooks Online about pushing a project as a sub-client. We suggest as best practices to not use the sub-client, to rather invoice Accelo as a top line item, so let's say that you're working with Hilton Worldwide, to then invoice Hilton Worldwide or their accounts team as a company, rather than pushing it as a sub-client, payments as well. Then, we have the opportunity to sync bills coming from QuickBooks into Accelo, so that's if I got the invoice or if I entered an invoice from the Jacksonville Print Company into QuickBooks Online, we can have that sync over to the Accelo side. In Xero, we don't have that option. We've just left it off for you.

Similar payment options, and then the exact same options on the import for coming in from QuickBooks Online, coming back into Accelo.

Now that we've gone through some of the import options, how can you start seeing what the import looks like? We'll hop into Accelo and see some of the options, and make any adjustments if we need to.

The first place to start is over in the companies side. What I see is, we have three customers sitting here. They're all active, and the Jacksonville Print Company coming in as a vendor and contact. If I go back to my Xero side, I can see the three clients sitting here, as well as my Jacksonville Print Company. It looks like those came in nicely.

Now over on the invoices side, it looks like our invoices all came through. Keep in mind, Tom and I set this up before the call, so it may be one hour or two hours before all of these invoices come in, especially if you have a lot of invoices. It's not totally instant, the companies and the suppliers are, but on the invoices side, there's more data that comes in, so it just takes a little longer as it queues up. It looks like the invoice came in, and the total owing amount or the payments came in as well. Then where we can see some of those items like account codes, tax information, service and materials, is through the configuration gear.

We'll first take a look at our invoices and rates section. What I first want to mention, this isn't necessarily part of the sync, but it is part of the overall design of getting paid for the work that you do out of Accelo, is our different integrations with credit card vendors. The two ones that we integrate with are Stripe and Authorize.net. We think that both of them are excellent, so the best practice is, use which one you've been previously using, or which one seems to make the most sense for your business. We're finding startups and smaller businesses are liking Stripe more, just because it's easier to set up and get going, though Authorize.net has a lower processing fee, mainly because it can hook up with a merchant bank. We're seeing some businesses who spend a little bit of extra time setting things up and have a merchant bank account using Authorize.net over Stripe.

Moving onto the tax codes, the four tax codes coming in from Xero are now showing up here. If I at any time want to import tax codes, instead of going to that integration page, I can come here to the tax codes and import from here. Our invoice or accounts have all pulled in, our purchases and our invoices.

Our expenses and types are here. This isn't necessarily part of the import, but it does reference some of the sales and the purchases, the sales tax, and the tax codes for purchases. Then the last piece of it is the materials and services that you may offer. These three items were already in the Accelo account, that's why we don't see a Xero logo, and then this one pulled in in the integration, as with the service items, the design, development, and ongoing work that we do with our clients.

[Tom] John, do you mind if I jump in with a quick question just around the [inaudible 00:17:50]?

[John] Yeah, absolutely, Tom.

[Tom] We had somebody ask, when we import invoices, how does Accelo [inaudible 00:17:59] assigned against a specific project or retainer, or do they just get imported?

[John] That's a very, very good question. The way that it comes in is, all that we know, because Xero and QuickBooks Online doesn't have a concept of retainer or project, but they do have a concept, absolutely, of a client or a supplier. We do know who it's against, we just don't know what it's against. It's something that you may find in your ongoing life using Accelo, is that anytime something's in the wrong place, it usually is pretty easy to relocate it.

In those cases an invoice comes in, all you have to do is relocate it to the right project, ticket, or retainer that it belongs to, and that is the way that you can then sync it up to the right object. Though what we're seeing as best practice, especially for older invoices, one or two years old, is that we're not actively looking at them or managing them, it's okay to just leave it against the company, and then all future invoices you send out of Accelo, out of the right area, project or retainer, and then it would maintain that link in the right place. Yeah, good question.

Then on the QuickBooks Online side, it's so similar, the import, that we'll skip over that section, but it does pull in the company list, the invoice list, as well as all the different setting items that you see here.

Now I wanted to share some best practices for financial control, what we can do to start templating some of our work and accounting pieces, so that when we start doing the work, tracking against it and invoicing it, all that data and information can seamlessly move into our accounting application. One place to start, and probably the easiest place to start implementing these best practices is around the invoice template. Let's take a look at that.

Here's an invoice template called fixed price. What it does across the three different areas that you can invoice, is it allows you to divine some things like percent budget, what we want to show on the invoice, but for our conversation today around financial control, what you can do is you can default the service item. Regardless of what is in the work item, especially if it's empty, you can make sure that the work here is pointing to the right service codes and the right accounts over on the Xero or QuickBooks side.

Then, likewise on the purchases, what you'll be able to do is template some of the purchases you make. In the example we're going through today, we're purchasing, or at least we're shipping off our designs to a print company and they're printing the brochures. In this case, the purchase, because we likely work with less vendors than we do clients, we can start templating who we send these to, so all of our print design goes to the Jacksonville Print Company. All of the prints that we get from them will then post to this material, which then relates back to a cost or a general ledger. We can template the email that gets sent out to Vince over there to let him know what we need and what we're asking for.

Then if we get into the work types, the project template is a really excellent place to start splitting out the type of work by different service items. Here in this project template, the website and brochures, often what we're seeing is putting service items against milestones. The design milestone, if I head over to the budget section, has a service item area. What I can do in this area is search all the different service items. These service items eventually connect to the GL codes, so in the design phase here, and then the development phase here. These are pointed to two different codes, so that on the Xero side, we're able to differentiate, how much revenue got brought on on design work versus development work, and how are we performing as a team or a company?

The last piece of the work side that we can start templating is on retainers. Because there's no concept of retainer templates, the templates are more or less types. You'll find some of this information underneath the type, like in this case, SEO prepaid. In here on the right side, we can start defining the service item for all the work that we do. Now anytime we sell a new retainer, all the work on there will be rolled up on the monthly invoice and synced to the correct general ledger area.

We've just gone through a lot of setup, and some of you may be thinking, "Well, when do we get to see it actually in action?" That's when the money comes in, when we start doing the work and actually sending the invoice, so let's jump in and see the money.

The scenario that we want to go through is, awesome, you've just signed on a new client, or it's the very end of the sales process, and what do we do now? How do we keep track of the work, and how do we, especially on the call today, make sure that the financial controls built into that process seamlessly translate into really easy invoices to send, and then eventually into our account platforms?

The first one that I want to go is do the Xero integration. We'll start all the way from a quote, collect an initial down deposit, keep track of the print purchase from the Jacksonville Print Company, and the traveling expenses for the client on site visits. Then, likely you would go through a final invoice and a final collection of payment as well. We'll skip over some of these tail end sections just for time today.

Let's say that we've had really good conversations with Ashland Springs Hotel. We likely already would have had a sale, but just in case someone on my new business team is a little lazy, let's create one quickly. This is a web and design for print opportunity. What I can do now is put together an estimate using the websites and brochures project template, and if you recall, we've not only templated the work that needs to be done, and the budget, but we've also dropped in these service items into the template as well. Finance team doesn't have to set up a service item or locate it to the right area. We can build this in from the very top of the funnel, even on the new business side on sales, and have that all stream in, so there's no double entry and no need to worry about the financial metrics streaming through.

Let's shoot this quote off to Stacey at the hotel. Since it's a fixed bid project, we'll hide all the time and materials information. Stacey either emails us back or calls us up and says, "Looking good, let's move on to getting this new website going." We can then convert that quote into a full-on project. If you're wondering the process and how you get to these quotes, if you're interested, it's under the sales section. You would create a new sales opportunity, you can quote for it, and then that quote would move from the sales side over to the projects side that you're seeing now.

Let's shoot off that initial down deposit. You could, on the fly, create an invoice, but if you really wanted to build into the process and make sure that things were happening in the right way, you can even build them into progressions. For example, this is a planned project, we haven't started it yet, we haven't resourced it. When we want to move it to active to begin doing work, we can then move it to the next stage. Some of our customers like to put an internal alert to the CFO to eventually come in and invoice, so here's one of the options that we can to kick off this invoicing process. It's an alert, it has a quick link to the project to be able to invoice.

Another option is just building the invoicing and doing the invoice into that flow as well. Here, shopping into invoice, I select the fixed bid amount. It's now asking to invoice for 50% of each phase. In here in the design phase, we can see that it's automatically related back to the service code design, and that service code is related back to services. In here, development is related back to development. One thing that we're seeing is relating it back to a general ledger, no pun intended, the most general being services, or we can have a more specific ledger like development. I'll change that here. In this case, I don't want to invoice for the print yet because I haven't ordered it and I don't know exactly how much it's going to cost.

The options that we can see down here, when we click save anytime on the invoice, it will automatically sync over to Xero in this case. Because we have it in the draft stage, we might not be comfortable yet sending it from Accelo. This would be what we wanted to do. If we clicked save and send, it would sync over to Xero but then also send that PDF to Stacey as an email.

Okay, great. We just sent off that quote, created a project, created the down deposit, and now we have some accounts receivable sitting on the Xero side. Let's create some of these purchases and travel expenses, and then we can hop over to Xero to see how they look.

One would be the materials. It's already sitting there nicely as something to eventually invoice. There'd be the expenses, and nothing yet. Let's say I'm just going to invoice them for some gas, and I'm not going to mark it up. On the materials side, I'm going to want to contact the Jacksonville Print Company, send them over the designs and start getting the ball rolling. I'm going to pull in that print line item from the project plan. It'll have the amount. I'm going to order 50 reams of brochures from them. It's pulling in all the right general and purchase cost side, and then I'm going to create a PDF and shoot this over to Vincent, so that he knows that we're looking for some more print items.

Let's fast-forward a little. Maybe it's time to invoice for the gas, and since we've gotten the correct estimate, and maybe fast-forward a few weeks and Vince has delivered the brochures and we've received them. Now it's time to invoice for those two items.

We can invoice for the other 50% of the project while we're at it. We've got the print coming in nicely, and then normally we would go through an approval process on the expenses, I've just not bothered to do that. Then we have the gas coming in. Let's save the invoice again. Great.

Here in the billing section, we'll be able to see any invoices that we've sent out, still outstanding, purchase, and a few other invoices sitting here. If we go over to the Xero side, on the sales or the revenue or the invoice section, we can see those invoices coming in as drafts because we want them to come in as drafts. If we had chosen it as authorized on Xero, it would come in as a waiting payment. Here we can see the items, and again, the benefit of it coming in as a draft is, we can make edits to it live just in case something doesn't look right. Here I'll move it into the approved section. Maybe I want to shoot an email over to the client.

Now I've moved it into the waiting payment phase. Let's take a look at those purchases that came through. Looks like we have some new ones in draft, 50 reams of brochures that have come in. Looks good as well. Not 100% good. Again, some of these small errors, it's nice to have it go through the draft phase so I can make adjustments and make sure that the integration is working well.

Let's add that payment. That payment will sync back, and then the invoice that we just sent out from Xero, if I move to my email section, that'll be coming through from Xero. I can take a look at it from the Xero link, and here I have the invoice coming in. All the items that I worked on in Accelo all populating, coming through, but again using Xero is the driving mechanism for sending out the invoices still, so that you don't disrupt too much of the flow by setting up the integration.

That would be the Xero integration, if I sync it over as a draft and use Xero as still the driving invoice mechanism. Now if I move over to the QuickBooks side, just a small change. We'll skip over that whole quoting process, and then we'll move through more or less the same flow, and then let's set up a final retainer and support contract.

[Tom] John, this might be a good time just for a couple of quick questions we've got here, if it's all right with you.

[John] Sure, yeah, that sounds great.

[Tom] Yeah, sure. One question we've got, where do the new purchases fall into the equation, also including materials and expenses? How do they all fit together?

[John] Sure. Do you think this is talking about how it integrates with Xero, or just on the Accelo side?

[Tom] Yeah, I suppose just generally with the new purchases, how do they fit into Accelo?

[John] Okay. Purchases like the print, they'll all start out as a material or an expense. Let's say I was purchasing something like a server or GoDaddy web hosting. Pens and paper, it's not billable, but it's reimbursable. These technically are both purchases, but the way to sync it over to your accounting platform would be through an official purchase. Here I can either add a material on the fly or pull it in from something that I've already logged, like pens and paper. Then I would search the vendor/company. If it was Staples for pen and paper, I might want to have Staples in my Accelo account. Then the purchase order would be if I was often working with another professional service company, someone to deliver the servers or deliver the print, but in the case of Staples, I just go to the store, I buy it, and then I put it here in the purchases account. Then moving over to the Xero side, if I come to the purchases area, see that draft sitting there and the waiting payment, so what I'll do is I'll pay my bills, more or less, from here as well.

[Tom] John, do you have any examples there of the materials or expenses from purchases sitting on general ledgers, by chance?

[John] Like within an account, like a roll-up?

[Tom] Yeah. We might not have [inaudible 00:38:59] any in advance.

[John] Yeah, probably getting a bit out of our expertise for here.

[Tom] No worries.

[John] Yeah, this is roll-up, but it's not detailed enough.

[Tom] Yeah, fair enough. Okay, thank you.

[John] Yeah. No worries. The chart of accounts might get a little bit closer to what we're thinking and looking for. Cost of goods sold, this is a roll-up for all the print material, and then if I dig into it, it's working with the Jacksonville Print Company. This is probably getting closer to what they're asking for, Tom. Great.

Moving over to the QuickBooks Online side, let's do more or less the same process. We'll skip over the quoting phase and go into a project.

In this case on the website, what I'm going to do is a time and materials project and not show the details of the different pieces. I would now put websites as a high level service item to differentiate the website work versus the custom development, versus the implementation and project work that I do. Because most time and materials don't take a down deposit, I'm invoicing biweekly or at the end of the month. Let's just log some time. I've begun doing the mock-ups. You know what? I've finished them today as well. Let's say by the end of the month, I've halfway through the next phase, the wire framing.

Same deal as before. Maybe I'm keeping track of gas and travel, and then I'll roll up the originally estimated materials for the print over to our friends at the Jacksonville Print Company. Today, because I've done so much work with them, they're going to give me a discount. Let's take off that service and testing. Normally they would charge me 20, but I'm doing a much bigger project so they're going to charge me 15 an hour for 100 pieces.

Now when it comes time to invoice for the time, billable rates, all the materials that we've sold or eventually delivered to the client, as well as any expenses that we've incurred, we'll use the time, materials, and expenses invoice. Maybe roll it up to the high level project level, pushing to website and sales. Don't want to invoice for servers, but we will invoice for those brochures. Again, it probably went through an expense approval process, but in this case, let's just override it. Because we're integrating all the way with QuickBooks, let's send the invoice from Accelo. Instead of clicking save like we did for Xero, we'll save and send the PDF to our customer.

Now we can see this invoice sitting here, and something that's different on the time and materials side is, using the invoice template, we want to show the client the time that we spent here to justify what we're invoicing for. This template includes who worked on it, the amounts, and the total roll-up as well. You know what? I realize that I haven't sent everyone the invoice, so let's see if there's anyone else who we need to send to. All right, shooting it off to them.

Now if I come over to my email, it's now being sent out of Accelo, that invoice will come from here. It will look like this. Once you get everything set up, there's no spoofing message, just an example of Gmail. Nicely rolled up in an invoice with what was exactly done, as well as an area to put my credit card, and because I'm integrating with Stripe now, I have the ability to share this page with what was done, as well as any credit card details. I can put them in here, process the payment, and then collect the payments and have those sync both ways, one to Accelo, and then one to QuickBooks Online.

In the case of today, let's just pretend that we got the payment from our credit card, and it was paid in full. Normally if they would've paid on Stripe, under the items and payment section, we would have seen this [inaudible 00:45:55] account as well as the token information here, and showing that the outstanding amount dropped down to zero.

Now I'm moving to the QuickBooks Online side. In my dashboard, we're seeing new invoices coming in. All my customers are already sitting there. Here we can see some of those new invoices coming through. All the time and materials for my web and print, the brochure and the gas, and then once the payment has been recorded, which we have, it just takes a few minutes for it to sync over. It'll start showing this as paid as well. The dual sync with invoice and payments, and then the area to add new products and services if you want to import them over to the Accelo side. That's the invoice. On the expenses side, we see all these bills that we're collecting from the Jacksonville Print Company for all the print jobs. I can record my payments here on the QuickBooks side, and then those will sync over to the project for me to be able to see if it's been paid or not.

Similar to what we showed, Tom, on the Xero side, just so that we can take a look at what it looks like on the QuickBooks side, we have started seeing the chart of accounts similarly, what's coming in and what's coming out.

Then the last part of the journey outside of the project would be just setting up a retainer. The initial website has gone well, now it's time to maintain and perhaps help them with their social media or SEO. We use one of those retainer types to pull in our different service items. I haven't set up the side on the QuickBooks Online side. We had edited it on the Xero side. Normally the service item would be connected to the type of retainer you'd be doing, so that's one part of it. Then the other is how we want to create the invoice to then sync over to, in this case, QuickBooks Online. I want to create the invoice and sync it over, or do I want to create the invoice and also send the client an email, and that PDF where they can then pay it monthly?